How Does the Apprenticeship Levy Work?

Learn how the levy works, how much you’ll pay, and how you can use your funds to build a successful apprenticeship programme.

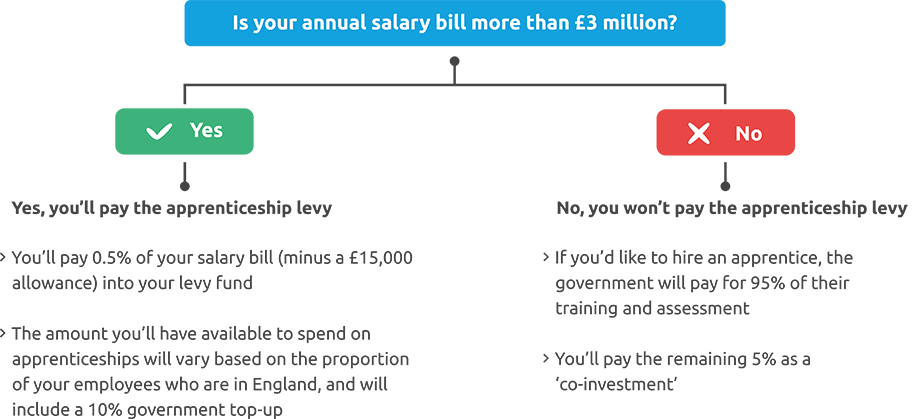

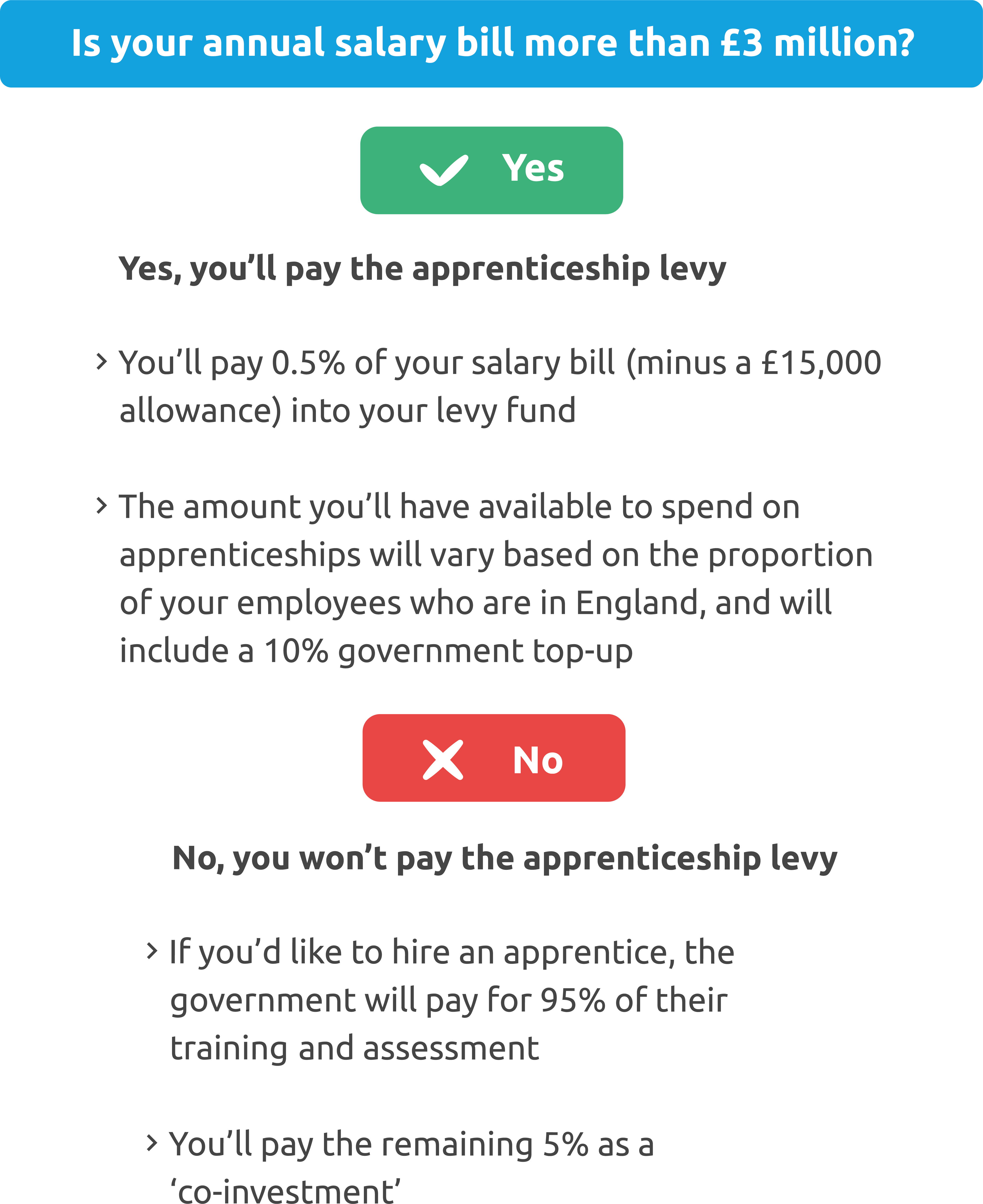

Does your organisation pay the apprenticeship levy?

Levy funds don’t last forever – don’t lose out

Any funds you don’t spend on apprenticeship programmes will expire after 24 months; for example, funds paid in May 2017 expired in May 2019.

In this 2-minute video, apprenticeship expert Dr. Sean McCready explains the apprenticeship levy and how to make it work for your organisation.

What can we spend our levy funds on?

You can only spend your levy funds on apprenticeship training and assessment for employees who work at least 50% of the time in England.

The training and assessment must be delivered by a provider that’s approved by Register of Apprenticeship Training Providers.

You can’t spend your levy on anything outside of this, such as your apprentice’s salary, admin costs, non-apprenticeship training, or travel expenses.

Apprentices can be:

Current staff or new starts

In entry-level, mid-level or senior roles

Any age as long as they’re over 16 – there’s no upper limit

Apprenticeship Levy Calculator

To calculate your levy, enter your annual UK payroll bill and the percentage of your employees who spend more than 50% of their working hours in England.

(Your annual UK payroll bill is defined as all payments to employees who are subject to employer Class 1 secondary National Insurance contributions, including wages, bonuses, and commissions. It doesn’t include payments to employees under 16 or payments for private-use benefits such as health care or company cars.)

Total levy contribution you’ll pay this year

(This is 0.5% of your annual UK payroll bill, minus a £15,000 allowance.)

Amount of your contribution transferred to your levy account

(This reflects your ‘English percentage’; for example, if 70% of your UK workforce is in England, 70% of your levy payments will be available to spend in your levy account.)

Total funds available to spend in your levy account

(A 10% government top-up will be added to the levy contributions that are paid into your account.)

Disclaimer: All figures are estimated annual amounts for illustrative purposes only. The exact amounts may vary, for example if your organisation is part of a group.

of employers say apprenticeships benefited their organisation

are happy with their apprenticeship results

plan to continue their apprenticeship programme

of employers recommend apprenticeships

The Centre for Economics and Business Research found that organisations achieve an average positive net gain of £1,670 per year for each apprentice, rising to £13,824 for management apprentices. Plus, each long-term apprentice delivers increased productivity worth roughly £10,000 per year.

Your step-by-step guide to using your levy funds

1

Register

First, register with the Digital Apprenticeship Service (DAS). This will let you see your levy funds, add and manage apprentices, and pay training providers.

2

Strategise

Speak to your HR team, finance department and other stakeholders to decide how to use your levy. Can you solve any skills gaps or weaknesses in your talent pipeline?

3

Choose

Decide if you’d like digital or classroom training, and choose your training provider. They’ll be able to advise you on setting up apprentices and managing your levy.

4

Prepare

Ensure your finance team is prepared and equipped to reconcile levy payments and training provider payments.

5

Recruit

Decide who will be an apprentice. Remember, apprentices can be current employees too – do you want to develop current staff or hire new talent?

FAQs

An apprenticeship is a paid job where the apprentice spends at least 20% of their work hours on ‘off-the-job’ learning. It can take place online from their office, in a classroom or workshop, or a mix of both.

HR and L&D apprentices who train with us and our partners spend much of their 20% learning time achieving a globally recognised professional CIPD qualification through self-directed online learning.

Instead of taking one day ‘off’ a week in order to meet the 20% training requirement, our apprentices can spread their learning into bite-sized chunks throughout their week, shaping it around their schedule and everyday tasks.

You must report to HMRC how much apprenticeship levy you owe each month using your Employer Payment Summary (EPS). You should be able to do this using your payroll software.

You’ll pay the levy each month though the PAYE process in the same way you pay income tax or National Insurance contributions.

If you have multiple PAYE schemes, you can allocate your £15,000 allowance between them as you choose.

If you’ve overpaid your levy during the year, you’ll receive a refund as a PAYE credit.

Apprenticeship levy payments are a deductible expense for corporation tax.

Register with the Digital Apprenticeship Service (DAS) to view your funds and use them to pay your training provider.

Your funds will show in your Digital Apprenticeship Service (DAS) account on the 23rd day of each month.

If you don’t have enough funds in your account to pay for training in a particular month, the government will make up 95% of the remaining cost and you’ll pay 5%.

This only applies up to the funding band maximum for each apprenticeship; any costs over the maximum must be paid out of your own budget.

If your organisation is a franchise or is connected to another company or charity, your group will only have one £15,000 allowance to share.

You can allocate this allowance between the connected companies or franchises as you choose.

You’ll have to report how you’ve allocated your allowance the first time you pay the levy. If you’d like to change the allocation, you’ll need to wait until the start of the next tax year.

No, all organisations in the UK with an annual pay bill over £3 million must pay the levy. There’s no way to opt out.

Remember, you don't need to hire new staff to use your levy funds - your current staff can be apprentices too.

There are apprenticeship available for a huge range of roles, including mid-level and senior positions. Think tactically about how you could use apprenticeships to close skills gaps or provide development opportunities for your employees.

Use your levy to develop a world-class HR or L&D team

Through our partners, we help provide CIPD-accredited HR and L&D apprenticeships that use self-directed online learning to maximise flexibility for your organisation.